By following these simple steps, you can start improving your credit score today!

Your credit report is one of the most important financial documents in your life. It provides lenders, landlords, and even potential employers with a detailed snapshot of your credit history. Whether you're applying for a new credit card, buying a car, or renting an apartment, your credit report plays a key role in these decisions. But what exactly is a credit report, and how can you use it to your advantage? Here's what you need to know.

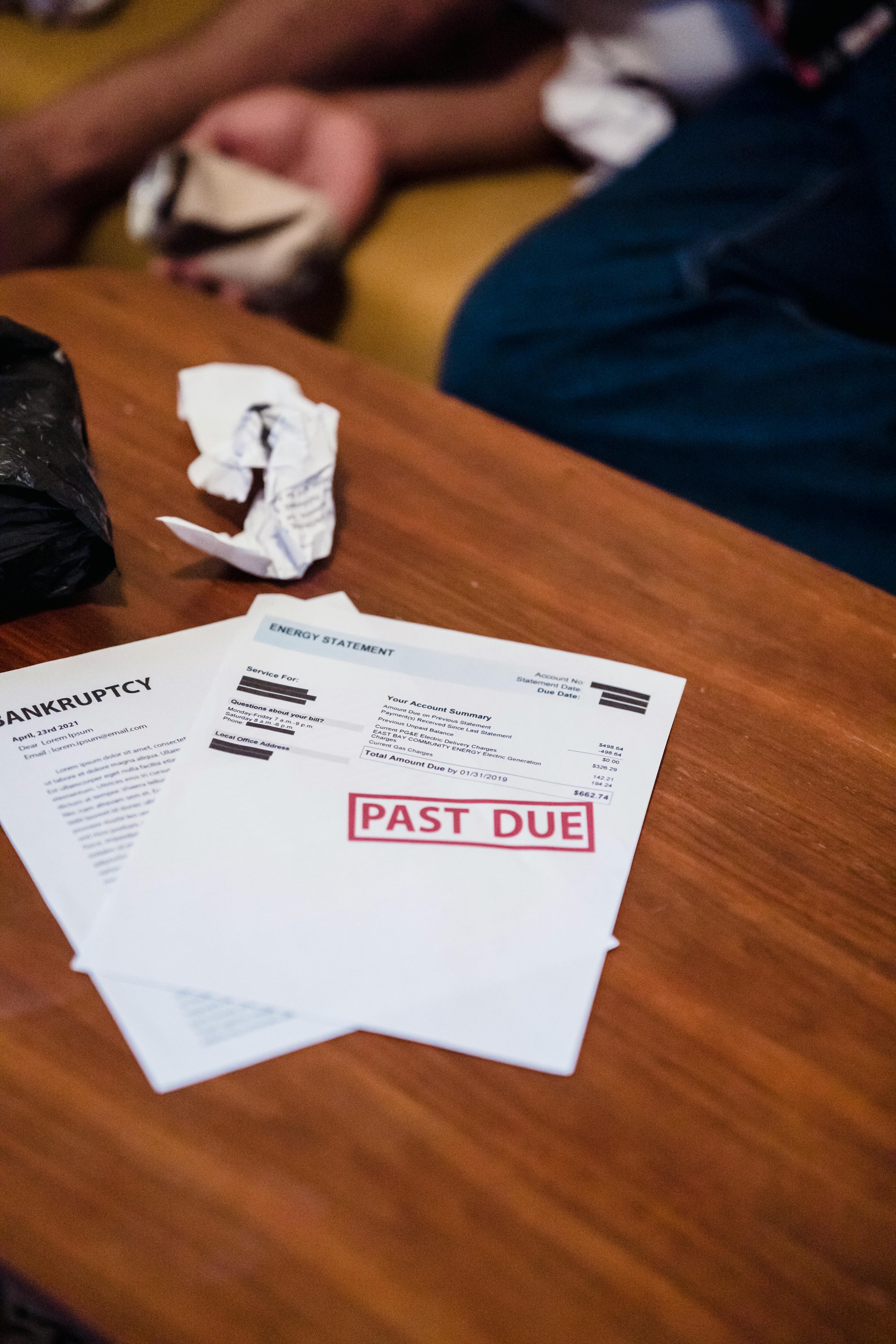

A credit report is a detailed record of your financial history, compiled by credit bureaus such as Equifax, Experian, and TransUnion. It tracks your credit behavior and includes information like your payment history, current debts, credit limits, and any public records like bankruptcies or foreclosures. Lenders and other parties use this report to assess your creditworthiness—essentially, how reliable you are in repaying debts.

Your credit report is crucial because it directly impacts your credit score, a three-digit number that gives lenders a quick way to assess your financial responsibility. The better your credit score, the more likely you are to receive favorable loan terms, lower interest rates, and higher credit limits. On the flip side, a poor credit report can lead to loan denials or high-interest rates.

For example, if you’ve been late on payments or have a high credit card balance, this could reflect negatively in your report, lowering your credit score. This is why keeping your credit report in good standing is essential to long-term financial health.

When it comes to credit, there’s no shortage of myths and misconceptions that can mislead consumers. Misunderstanding how credit works can hurt your financial health and make it harder to achieve your financial goals. To set the record straight, let's debunk some of the most common credit myths and get to the truth about how to manage your credit effectively.

Checking your own credit report is considered a “soft inquiry” and has no impact on your credit score. In fact, regularly reviewing your credit report is a smart practice to spot errors and monitor your financial health. Only “hard inquiries,” such as those made by lenders when you apply for credit, can slightly lower your score.

Fact: While it might seem logical to close old, unused accounts, doing so can actually hurt your credit score. One key factor in calculating your score is your credit utilization ratio—how much of your available credit you're using. Closing a card reduces your available credit, which can increase your utilization ratio. Additionally, the length of your credit history matters, and closing older accounts can shorten that history.

Fact: Carrying a balance doesn’t help your credit score—paying off your balance in full every month does. While it’s important to use your credit card regularly to build credit, you don’t need to carry a balance. In fact, doing so can lead to unnecessary interest charges, increasing your debt.

Fact: While lenders will consider your income when deciding whether to approve you for credit, your income has no direct effect on your credit score. Credit scores are based on your financial behavior—how well you manage your debt, pay bills on time, and how much credit you’re using—not your income level.

Fact: Your credit score and credit report are closely related, but they are not the same thing. Your credit report is a detailed history of your credit accounts and financial activity, while your credit score is a three-digit number derived from that information. Checking your credit score gives you a general idea of your credit health, but you should also review your full credit report to see all the details.

Fact: Just because you’re approved for a loan or credit card doesn’t mean your credit is in excellent shape. Lenders may approve you for credit even if your score is mediocre, but you’ll likely pay higher interest rates and have less favorable terms. It’s important to aim for a high credit score to secure the best financial deals.

In today’s financial world, your credit score is more important than ever. It affects your ability to get loans, credit cards, mortgages, and even affects your ability to rent an apartment or get a job in some cases. With so much riding on your credit, it’s critical to stay on top of your credit health. This is where credit monitoring comes in. But what exactly is credit monitoring, and why does it matter so much? Let’s explore the power of credit monitoring and how it can help protect your financial future.

Credit monitoring is a service that tracks your credit report and alerts you to any changes or suspicious activity. These services can notify you if there’s a new credit inquiry, a significant change in your credit score, or if new accounts have been opened in your name. Some credit monitoring services also offer identity theft protection and tools to help you improve your credit score.

By keeping an eye on your credit, you can catch potential issues early—like fraudulent activity or reporting errors—that could harm your credit score and your financial opportunities.

Identity theft is one of the fastest-growing crimes, with millions of people affected every year. When someone steals your personal information to open fraudulent accounts or make unauthorized transactions, it can wreak havoc on your credit. By the time you discover the issue, the damage may already be done.

Credit monitoring services can alert you the moment there’s suspicious activity on your credit report, giving you the chance to act quickly. Whether it’s an unauthorized account opening or an inquiry you don’t recognize, early detection is key to minimizing the impact of identity theft.

Mistakes on your credit report are more common than you might think. According to studies, around 1 in 5 consumers have a credit report error that could affect their score. These errors can be as simple as a misspelled name or incorrect payment information, but they can significantly damage your credit if left unresolved.

By using credit monitoring services, you can receive alerts about changes to your report. This allows you to quickly spot and dispute any inaccuracies before they affect your credit score or financial reputation.

Your credit score can fluctuate for many reasons—whether it’s because of a large credit card payment, opening a new line of credit, or paying off debt. Monitoring your credit helps you stay on top of these changes and understand how different financial decisions impact your credit score.

For instance, if you’re planning to apply for a mortgage or car loan, monitoring your credit in the months leading up to your application can help you ensure your score is in top shape. You’ll be able to identify areas for improvement and make adjustments before lenders assess your creditworthiness.

Many credit monitoring services offer more than just alerts—they provide valuable tools to help you improve your credit score. From personalized tips to payment reminders, these services can help you make informed decisions about managing your debt, lowering your credit utilization, and improving your overall financial health.

Having access to your current credit score and understanding the factors that influence it empowers you to make better financial choices. Whether you’re trying to raise your score for a loan application or simply want to maintain a healthy credit profile, credit monitoring provides the insights you need.

When you’re about to make a significant financial move, such as applying for a mortgage, renting an apartment, or financing a car, your credit report will be under scrutiny. Credit monitoring helps you prepare by keeping you informed of any recent changes to your credit score or report. You’ll know exactly where you stand before lenders or landlords run a credit check, giving you time to address any issues or improve your score if needed.

One of the most powerful benefits of credit monitoring is peace of mind. Knowing that your credit report is being monitored around the clock can alleviate the stress of constantly checking for suspicious activity or errors yourself. You’ll be notified the moment something changes, allowing you to focus on other aspects of your life without worrying about potential threats to your financial well-being.

Not all credit monitoring services are created equal, so it’s important to choose one that fits your needs. Some services provide free basic monitoring, while others offer premium features such as identity theft insurance, regular credit score updates, and access to all three major credit bureaus (Equifax, Experian, and TransUnion).

When selecting a service, consider what level of monitoring you need, whether you want identity theft protection, and how frequently you want to receive updates on your credit score.

Credit monitoring is a powerful tool for protecting your financial health. By keeping track of your credit report and alerting you to changes, it helps safeguard you from identity theft, errors, and any other potential issues that could harm your credit score. Whether you're planning a major purchase or just want peace of mind, credit monitoring provides the security and insight you need to stay financially secure. Make credit monitoring part of your routine and take control of your credit future today!

Your credit report plays a vital role in your financial life, from determining loan approvals to setting interest rates on mortgages and credit cards. Unfortunately, credit report errors are more common than many people realize. A simple mistake could negatively impact your credit score, leading to loan denials, higher interest rates, or even rejection for rental applications. The good news is that disputing errors on your credit report doesn’t have to be complicated. With the right approach, you can correct inaccuracies and ensure your credit report reflects your true financial standing. Here's how to dispute credit report errors like a pro.

Before you can dispute any errors, you need to review your credit report closely. Under the Fair Credit Reporting Act (FCRA), you're entitled to a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once a year through AnnualCreditReport.com. Reviewing all three is essential, as each may contain different information.

When examining your credit report, look for the following common errors:

Once you’ve identified the errors, the next step is to gather documentation to support your dispute. For instance, if you’re disputing a payment that was reported late, you should collect bank statements, payment receipts, or correspondence with the creditor that shows the payment was made on time. Having concrete evidence to back your claim strengthens your case and makes it easier for the credit bureau to correct the error.

To initiate the dispute process, you’ll need to contact the credit bureau(s) that reported the error. You can do this online, by mail, or by phone. Most credit bureaus offer an easy online form to submit your dispute. If you’re sending a letter by mail, be sure to include:

Here are the online dispute portals for the three major credit bureaus:

Make sure to keep copies of all your correspondence and documentation for your records.

In addition to filing a dispute with the credit bureaus, you can also reach out directly to the creditor (such as your credit card company, mortgage lender, or auto loan provider) that reported the error. Many creditors have their own dispute process, and correcting the mistake at the source may speed up the process.

When contacting the creditor, explain the error in detail and provide any supporting documentation to back up your claim. Often, the creditor will investigate the issue and report the correction to the credit bureaus.

The credit bureau is required to investigate your dispute within 30 days of receiving it. During this time, they will contact the creditor or institution that reported the information to verify its accuracy. After the investigation is complete, the credit bureau will send you a letter detailing the outcome, which will either confirm the error has been corrected or explain why they believe the information is accurate.

If your dispute is successful, the error will be corrected or removed from your credit report, and your credit score should reflect the update. However, if the bureau rules against you and you still believe the information is wrong, you have the right to add a consumer statement to your credit report, explaining the dispute in your own words.

Even after resolving an error, it’s essential to continue monitoring your credit report regularly. Errors can sometimes reappear, or new issues may arise. By staying on top of your credit reports and using credit monitoring services, you can ensure your credit report remains accurate and up to date.

If your dispute is denied and you’re still convinced the information is wrong, you have options. Here’s what you can do:

Disputing errors on your credit report may seem intimidating, but it’s a crucial step in maintaining your financial health. By taking a proactive approach, gathering the right documentation, and following the correct procedures, you can correct inaccuracies and protect your credit score. Stay vigilant by reviewing your credit report regularly, and don’t hesitate to dispute any errors you find. With these steps, you can dispute credit report errors like a pro and ensure your credit report accurately reflects your financial history.